TAL Education Stocks: Excel Potential (NYSE:TAL)

Pikusisi-Studio/iStock via Getty Images

Chinese and Western cultures open up markets amid tensions between two blocs over various issues

Russian invasion of Ukraine, human rights violations in Xinjiang, annexation of Taiwan China policy and the tariff war are almost daily debates in the relationship between the United States and the People’s Republic of China.

This gives the impression that two rival systems are constantly fighting and trying to claim each other.

However, although ideologically opposed, these two colossal systems coexist on the basis of strong market ties.

China provides fertile ground for all types of investment activity, and the western world of the United States and Europe transfers vast amounts of capital to finance various manufacturing and service sectors in mainland China. .foreign direct investment [FDI] Inflows to mainland China increased nearly 22% year-on-year in the first half of 2022 to reach $112.4 billion. [up 26%] and Germany [up 14%] The Ministry of Commerce reported on 29 July.

Capital from Western investors seeking to escape China’s growth amid saturated markets is complemented by strong momentum in the local real economy as the People’s Bank of China further cuts interest rates and launches repo agreements. It has been.

China’s central government focuses on school system to achieve world’s first gross domestic product

Strong support for education is one of the country’s key efforts in pursuing the world’s first Gross Domestic Product (GDP) target. Large educational systems that train future generations of managers must continually adapt to the changing business and industrial environment. This is because it is integral to the transformational process that began decades ago from underdeveloped agriculture-based societies.

According to a July 2022 statement from the National Bureau of Statistics, investment in the education sector will grow the most in the first half of 2022, alongside that in healthcare, despite global uncertainties and the resurgence of COVID in the country. It shows China’s determination to boost growth without a doubt. -19.

With a smaller portfolio and possibly a more efficient organization, TAL Education Group is seizing the growth potential of Context

This context is from the TAL Education Group (NYSE:TAL) business was successful, but the company had to abandon many initiatives to comply with the new regulatory guidance.

As schools have been instructed not to give too much homework to students in order to have time for family life and leisure, the Xi Jinping government has decided to add some tutoring classes in addition to measures affecting the private education sector. is prohibited.

Beijing-based TAL Education Group, which provides K-12 tutoring in various subjects in mainland China, has had to suspend many educational programs, including tutoring during weekends, holidays and school holidays. did not.

Smaller portfolio of initiatives, but looks more efficient to operate:

Sales dropped significantly as many initiatives were canceled under the new Watchdog guidelines. The same is true for the first quarter of fiscal 2023. [ending May 31, 202]revenue fell 84% year-over-year to $224 million.

|

item |

Q4 FY2021 [ended on Feb. 28, 2021] |

Q1 FY2022 [ended on May 31, 2021] |

Q2 FY2022 [ended on Aug. 31, 2021] |

Q3 FY2022 [ended on Nov. 30, 2021] |

Q4 FY2022 [ended on Feb. 28, 2022] |

Q1 FY2023 [ended on May 31, 2022] |

|

net income |

$1,362.7 million |

$1,384.9 million |

Unpublished |

$1.0209 billion |

$541.2 million |

$224 million |

|

Total project cost |

$1.069 billion |

$759.3 million |

$563.6 million |

$308.9 million |

$163.8 million |

|

|

Adjusted operating profit [Loss] |

[$216.9 million] |

[$59.4 million] |

[$67.6 million] |

$800,000 |

[$1.8 million] |

|

|

Adjusted net income [Loss] |

[$88.7 million] |

[$34.6 million] |

[$58.6 million] |

[$108.0 million] |

[$17.4 million] |

|

|

Adjusted net income [Loss] per American Depositary Share. [3 ADSs = one Class A common share] |

[$0.14] |

[$0.05] |

[$0.09] |

[$0.17] |

[$0.03] |

As shown in the table above, TAL Education Group may have achieved significant reductions in operating costs over the past few quarters.

If a company can make the virtue of necessity, after phasing out some tutoring activities, it can turn to a much more efficient structure, ultimately positively impacting profits, margins and share price. brings results.

It’s not easy, stocks are currently at high risk of failing to invest, but at the same time have incredible upside potential as there are interesting markets to reach or develop in the ecosystem operated by TAL Education Group there is.

The positive and interesting megatrends in compulsory education of the TAL Education Group initiative show the need to meet additional demands or open new markets.

However, certain megatrends in China’s compulsory education sector offer many opportunities for companies like TAL Education Group that want to develop initiatives aimed at supporting public education programs.

These positive megatrends are reflected in the following developments recently announced by the Ministry of Education:

China currently has nearly 160 million students in 207,000 schools, providing six years of primary education and an additional three years of lower secondary education. The coverage area is so large that it can inspire many ideas for new initiatives in the tutoring industry even after the Chinese government’s strict measures.

Also, as a provider of tutoring, TAL Education Group leverages the government’s goal of promoting education through financial grants to underprivileged families in rural areas where many students still drop out due to financial reasons. can.

This problem is prevalent in Chinese society. As many counties seek to emerge from underserved economic and social conditions before finally achieving balanced compulsory education development across mainland China.

The central government’s emphasis on educational programs for persons with disabilities is another area of potential demand for tutoring.

The company’s balance sheet looks solid

As of May 31, 2022, the balance sheet reported cash and marketable securities of $2.9 billion and net trade debt of $178 million.

The company’s financial position is expected to remain solid in the future.

Analyst revenue growth forecasts, recommendations and price targets

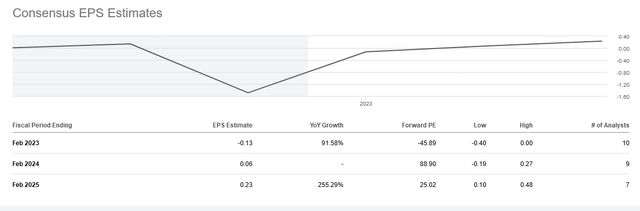

Analysts expect earnings per share [EPS] Q4 FY2023 [ending February 28, 2023] A net loss of $0.13, a 91.58% improvement over the previous year. Toggle net income of $0.06 in fiscal year 2024 and confirm net income of $0.23 in fiscal year 2025.

seek alpha/symbol/tal/earnings/estimate

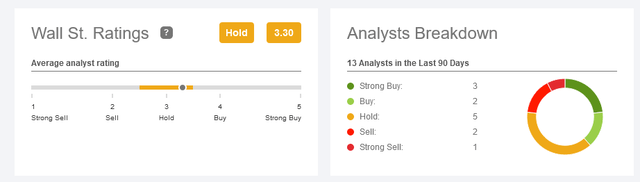

Wall Street issued 3 strong buy, 2 buy, 5 hold, 2 sell, and 1 strong sell ratings and determined the median recommended hold rating.

Ask Alpha/Symbol/TAL/Rating/Sell Rating

The stock has a price target of $5.3 as an average ranging from $2.90 to $7.20.

Ask Alpha/Symbol/TAL/Rating/Sell Rating

Shares above long-term trend but still attractive

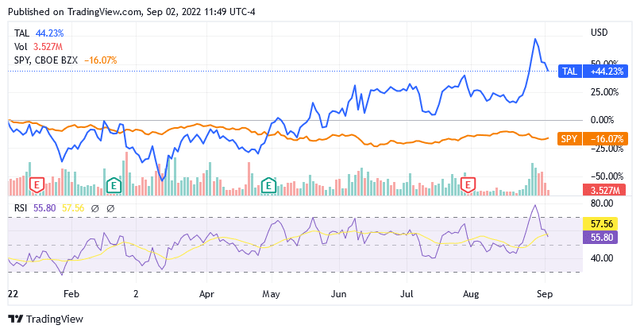

TAL Education Group is up more than 44% so far this year, outperforming US market benchmark SPDR S&P 500 ETF Trust (SPY), which has actually gone in the opposite direction.

seekalpha.com/symbol/TAL

At the time of writing, the shares are trading at $5.47 each, with a market cap of $3.74 billion and a 52-week range of $1.60 to $6.71.

A 200-day moving average of $3.93 means the stock is currently trading above its long-term trend, but given the potential for a big upside, this doesn’t affect its appeal.

Stocks not overbought after year-to-date gains as 14-day relative strength indicator [RSI] is 55.80 and is well below its subsequent high of 80, so the stock could still rise rapidly.

Equities have a five-year monthly beta of -0.15 because they move in the opposite direction of the stock market, albeit at a much slower pace than the market.

This is interesting as the market is expected to continue to fall in the aftermath of the war in Ukraine, which includes runaway inflation, tight monetary policy by the US Federal Reserve and the European Central Bank, and headwinds from energy concerns.

Bottom Line – Small Business According to New Watchdog Guidelines, but Catalyst Worth Considering a Holding

TAL Education Group had to suspend its initiative to comply with new regulations in the field of educational instruction.

This resulted in lower sales, but if total operating costs can be significantly reduced, there could be some interesting trends in operating profit.

China’s compulsory education industry offers many opportunities, and if the company takes advantage of them, it’s justified to hold the position, even if it’s a risky investment these days.